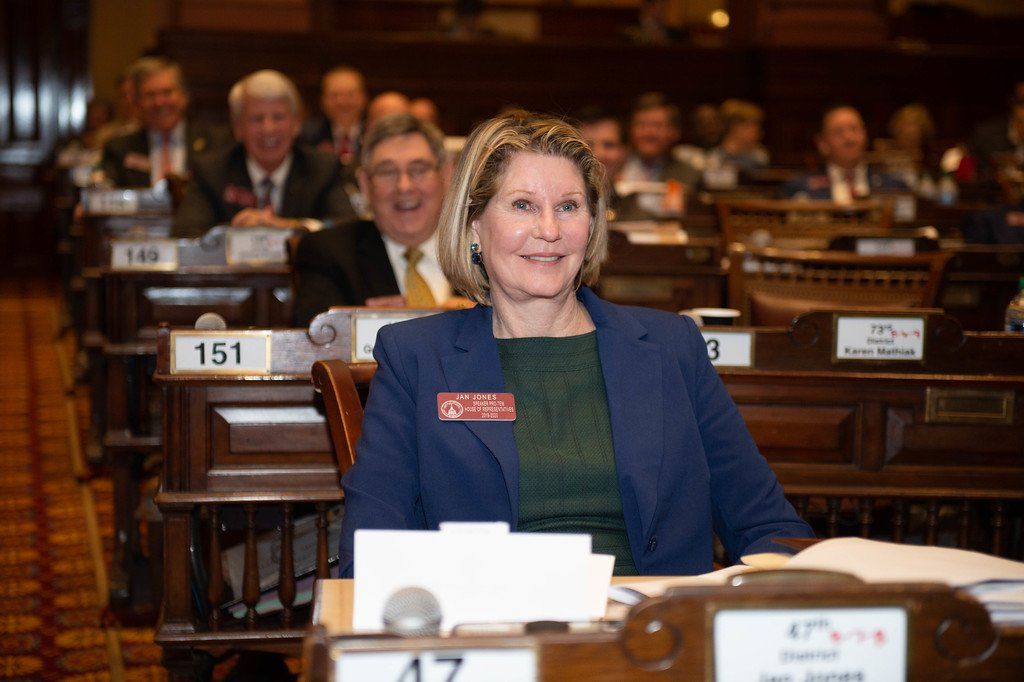

Jan Jones.Caring. Trusted. Community Leader.

DONATE

Join Our Team Today

Join Team Dolezal Today

Meet Jan

City skyline

Photo By: John Doe

Button

Jan has distinguished herself as a passionate advocate for changing lives and increasing economic opportunities through improved public education and government closer to the people.